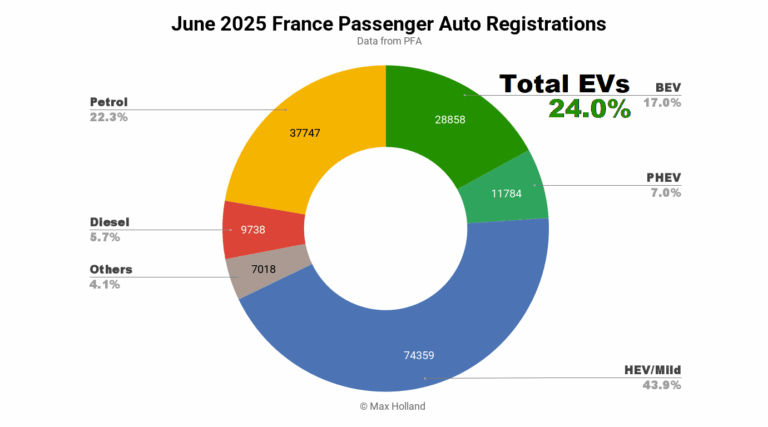

June’s auto market saw plugin EVs at 24.0% share in France, flat from 24.1% year-on-year. BEVs saw marginal growth in share YoY, whilst PHEVs were slightly down. Overall auto volume was 169,504 units, down some 7% YoY. The Tesla Model Y was France’s best-selling BEV in June.

June saw combined EVs at 24.0% share in France, with full battery electrics (BEVs) at 17.0%, and plugin hybrids (PHEVs) at 7.0%. These compare with YoY figures of 24.1% combined, 16.4% BEV, and 7.7% PHEV.

The big picture in France (and elsewhere) is that steadily tightening emissions regulations are forcing change on the auto industry. However, the big legacy auto companies are still mainly prioritising the short-term solution of adding mild-hybrids (MHEVs) and plugless hybrids (HEVs) to their offerings, rather than going all-in on plugins, especially BEVs.

These MHEVs and HEVs are stop-gap short-term solutions because they can only go so far in reducing emissions, as they are still mostly based around ICE engines. In the longer term, BEVs will have to make up the vast majority of sales to meet fleet emissions requirements and alleviate urban pollution. Crucically, BEVs also have lower total cost of ownership over the vehicle’s life, and thus give significant savings to consumers, another compelling reason why their eventual ascendancy is inevitable over time.

Legacy auto’s delaying tactics, and lack of serious EV focus, are driven by last-gasp rent-seeking on old ICE investments, a species of sunk-cost fallacy, even whilst it has long been clear that BEVs will win out in the longer term. Long-term planning and thinking, broader societal goals, with modest (and sustainable) returns on investment — these ideas are not typically found in the vocabulary of neo-liberal capitalism (the social context of legacy auto and its financiers). Instead, short-term quarterly balance-sheet profiteering dominates thinking, even as it sows the seeds for its own long-term ruin.

In the adjacent graphs, we can see this rapid switch from ICE-only sales, to MHEV/HEV sales over recent years (blue segments denoting the latter powertrains). Meanwhile, plugins have barely grown in France over the past two years, even whilst their inevitable rise continues in a few other European markets – and especially in China and some other regions that have escaped rent-seeking neo-liberal hegemony.

As I’ve recently emphasised, the one silver lining is the recent (yet long-awaited) emergence in Europe of somewhat-affordable competent BEVs. These are now starting to pick up significant sales volumes, and may ultimately compete with each other (unless minimum-price fixing occurs) to get the EV transition moving forward once again.

Best Selling BEV Models

After some delays, sales of the new Tesla Model Y have increased in France, which registered 3,235 units in June. May’s leader, the Renault 5, dropped to second place in June, with 2,829 units. A long way behind, with 1,100 units, the Renault Scenic took third spot.

The new Tesla Model Y had seen delays in its eligibility for the eco-bonus in France, recording only a few hundred French deliveries in both April and May. This eligibility question was resolved in the updated government list of June 18th, which then opened the floodgates to substantial delivery volumes in the last 12 days of the month. We will need another few months to see what the “new normal” is for the Model Y, and whether it can sustain something close to the demand levels it enjoyed in France over the past couple of years.

Although pushed down to second place by the Model Y, the Renault 5 still saw strengthening volumes in France, some 10% more than its January-to-May average sales. This healthy performance comes despite the recent launch of its non-identical twin, the new Renault 4, which rests on the same platform, but is around 10% larger in its dimensions. The Renault 4 itself is off to a good start, with sales climbing to 539 units in June, enough to secure 12th position in the rankings, and surely further to climb. Their close competitors, the Citroen e-C3, and especially the e-C3 Aircross, both seemed to be on a rest-break in June, but will surely be back to strength in the coming months.

Not-on-a-break was the new Skoda Elroq, which continued to rapidly climb, with a new high of 943 units in June, taking 4th position, a great result.

The Dacia Spring has come back to good strength in recent months, though with somewhat uneven monthly shipping volumes. June was a high-volume month, with 925 units, enough to secure fifth rank.

As usual, we unfortunately don’t have timely data which extends beyond the top 20 best-selling BEVs, so we can’t record the quiet debut of new models further down the rankings. We will have to wait for anecdotal news on these, or for them to later climb into the top 20 and become visible to us.

Meanwhile, here’s a look at the trailing 3-month rankings:

The consistent monthly strength of the Renault 5 resulted in a strong lead in the 3-month chart, well ahead of the Tesla Model Y, which was dragged down by those low volumes in April and May mentioned above.

The Skoda Elroq has climbed to 6th, and may get into the top 5 in the next month or two, unless the (now aging) Peugeot e-208 can find new vigour. Presumably the latter is now being overshadowed by the newer generation BEVs, the Renault 5 and Citroen e-C3, which – despite being about 120 mm shorter – are built on more space-efficient platforms.

Outlook

June saw the overall French auto market still stuck in diminishing YoY volumes, a trend which has lasted most of the past 12 months. In the broader French economy, the latest macro GDP data remains that from Q1, showing just 0.6% YoY growth. Inflation crept up to 0.9% in June, from 0.7% in May. ECB interest rates further declined to 2.15% in early June, from 2.4% in May. Manufacturing PMI fell back to 48.1 points in June, from a brief uptick to 49.8 points in May.

What are your thoughts on France’s auto market, and the prospects for the EV transition? Are these new small and affordable BEV models going to result in a return to positive growth? Or will their available volumes (from legacy auto) be too limited to make much difference? Please join the discussion below with your perspectives, thoughts and questions.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Whether you have solar power or not, please complete our latest solar power survey.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

Advertisement

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy