Allison and Dana are not household names in the electric vehicle field on the order of, say, Tesla. However, the two US-based firms have been in the propulsion business for more than 100 years apiece, and last month they completed a $2.7 billion transaction aimed partly at cementing their respective footprints in global electric vehicle markets.

The Global Electric Vehicle Market Is Calling

EV sales in the US face a somewhat uncertain future domestically, due to an abrupt shift in federal electrification policy this year. Nevertheless, so far, US demand for EVs has held steady, with the notable exception of Tesla.

General Motors, in particular, is very excited about EV sales in the Q2 report it posted earlier this week. In addition, global EV sales continue to rise at a healthy clip, BYD’s electric truck division being one outstanding example. Regardless of domestic policy, US-headquartered firms with a global footprint are following the money.

Both Allison Transmission Holdings of Indiana (founded 1915) and Dana Incorporated of Ohio (founded 1904) are diversified drivetrain and propulsion firms with a firm grip on the internal combustion engine business. Still, as Allison noted in a press release last month, there is money to be made in vehicle electrification.

On June 11, Allison announced that it has acquired Dana’s off-highway business. The $2.7 billion transaction “aligns with Allison’s strategic priorities to expand its emerging markets footprint, enhance core technologies and deliver strong financial results,” Allison explained.

“Upon completion of the transaction, Allison will be able to offer a wider range of commercial-duty powertrain and industrial solutions to more customers and end users worldwide,” the company added.

Combining “emerging markets” with “worldwide,” it sure seems like Allison has bigger fish to fry than the US electric vehicle market. To re-emphasize again, the company does not intend to drop its core business like a hot potato, but the company’s focus on the EV-friendly Asia-Pacific market indicates that the transition to the electric vehicle market is under way.

The Dana transaction is not a one-off. Allison has been investing in its vehicle electrification portfolio over the years, including a new R&D facility in Michigan. The Dana acquisition kicks the activity level up a notch.

“This acquisition marks a transformative milestone in our commitment to empowering our current and future customers with propulsion and drivetrain solutions that Improve the Way the World Works,” emphasized Allison Chair and CEO David Graziosi in a press statement.

“We look forward to harnessing this momentum to increase value for all of our stakeholders worldwide,” he emphasized again.

What’s In It For Dana?

Meanwhile, Dana has been on an electrification journey of its own. The shedding the off-highway line was an unexpected windfall for the company’s future plans. At $2.7 billion, the transaction “represents 7x the expected 2025 adjusted EBITDA of the Off-Highway business,” Dana reported in a press statement, with EBITDA referring to the standard financial measurement Earnings Before Interest, Taxes, Depreciation, and Amortization.

As with Allison, Dana has no intention of dropping the ICE shoe any time soon. However, alongside other cost-cutting measures the Allison transaction will enable Dana to focus more closely on the growing demand for electric vehicles among fleet owners.

“As we committed to last year, the sale of the Off-Highway business supports our strategy to become a streamlined light- and commercial-vehicle supplier with traditional and electrified systems,” explained R. Bruce McDonald, Dana’s Chairman and CEO in a press statement on June 11.

“Dana has taken a leading position in vehicle electrification. In fact, with in-house gearbox, low- to high-voltage motor, inverter, controls, and thermal and battery management expertise, we are the only supplier capable of delivering all elements of a complete, fully integrated electrified system across all mobility markets,” Dana reminds everyone on its website. The company also launched the LEED-certified Sustainable Mobility Center at its World Headquarters campus in Maumee, Ohio in 2022.

The fleet market is an all-important one for Dana, which has had a bumpy ride over the past several years. If all goes according to plan, the Allison transaction will help Dana keep up with the Joneses as it navigates the fleet industry’s transition to electrification and digitization (see more fleet electrification background here).

Dana already has a head start through its existing relationships in the ICE world. In April, for example, Dana announced that it earned the 2025 Supplier of the Year Award, issued by the leading heavy duty vehicle aftermarket distributor FleetPride.

“This award is given to the supplier partner who excelled in all aspects of Communication, Partnership, Innovation, Training, and Growth,” said FleetPride representative Michael Keller, who cited Dana’s real time call center, product innovation, and habit of “being the first to sign up for new and recurring marketing opportunities.”

The Electric Vehicle Market Is Not Going Away Any Time Soon

As for the US, last week lawmakers in Congress voted in favor of a new tax bill that strips out a $7,500 tax credit for new EVs. The timing is bad, considering that leading US automakers — including Tesla — have pledged to introduce more affordable EVs soon. Loss of the tax credit will eat away at the affordability potential.

The consensus is that EV sales in the US will nosedive after the tax credit disappears in September, but then again, EVs have been relatively expensive all along. Until a truly “affordable” EV emerges, electric vehicles are cars for above-average income earners. If these high-dollar households can shrug off the loss of the tax credit, EV sales will slow, but not crash.

So, why should a high income household shrug off the tax credit? Some won’t but some will, for the same reasons they have proved willing to spend relatively large sums of money on EVs now. The benefits kick in particularly when home EV charging is involved. Home EV charging adds a next-level level of convenience that is unavailable to gasmobile drivers.

Virtual power plants and other demand-response programs also enable charging-enabled households to get a break on their electricity rates by recharging during off-peak periods, but the real benefits kick in when an emergency strikes. Electric vehicles with bidirectional charging capability can send power into the home when the grid goes down. Aside being useful during grid outages, EVs are also handy during other types of emergencies when local fuel supplies are disrupted and long lines form at gas stations.

What do you think, will loss of the tax credit pull the rug out from under the electric vehicle movement in the US, or just slow down the US while the rest of the world moves on? Drop a note in the comment thread or better yet, find your representatives in Congress and let them know what you think.

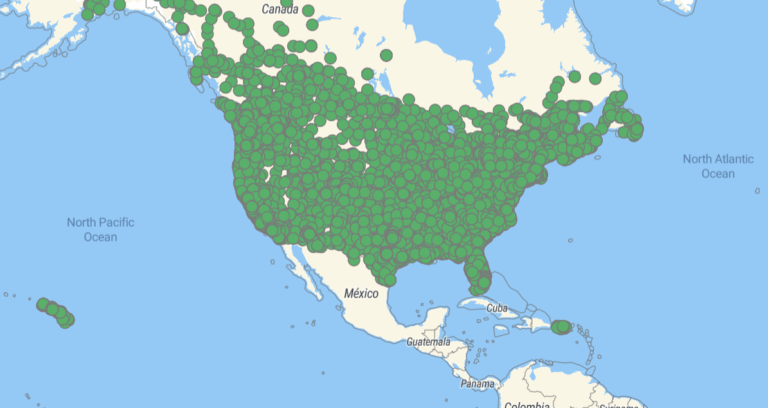

Image: Electric vehicle charging stations in the US via US Department of Energy.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Whether you have solar power or not, please complete our latest solar power survey.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

Advertisement

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy